January 18, 2023

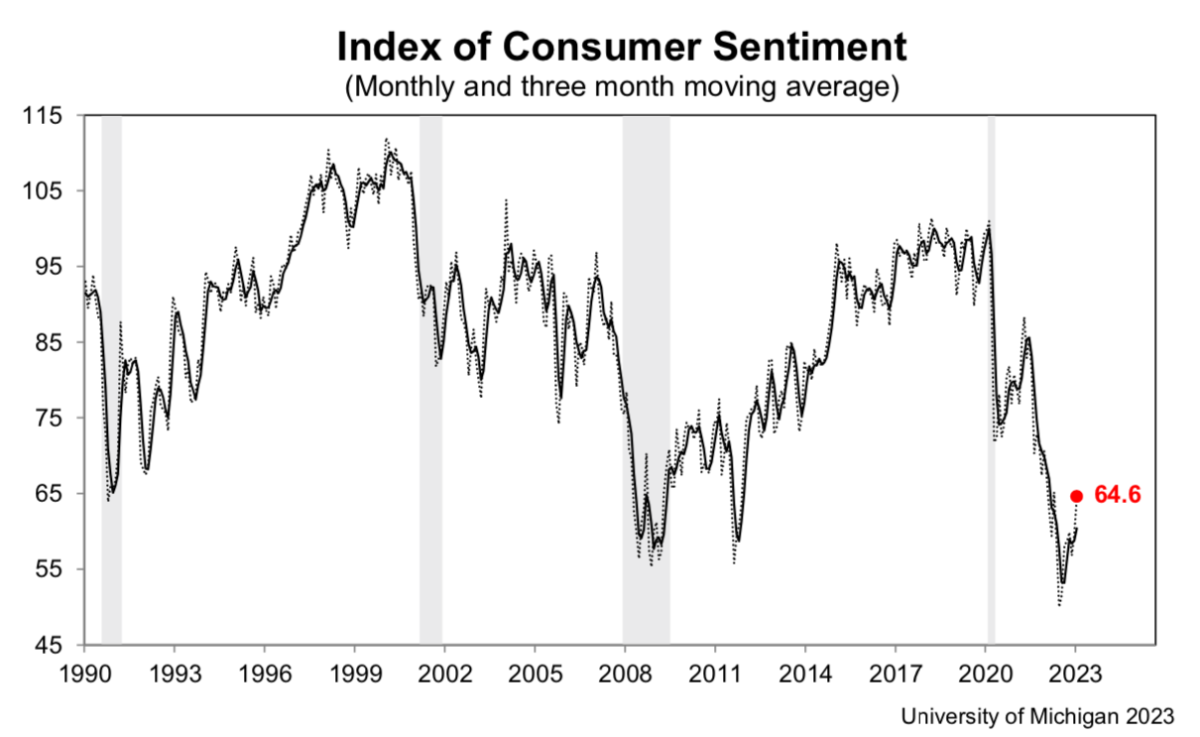

The University of Michigan’s US Consumer Sentiment gauge rebounded +8.2% in December to 64.6, though that is still down -3.9% from a year ago.

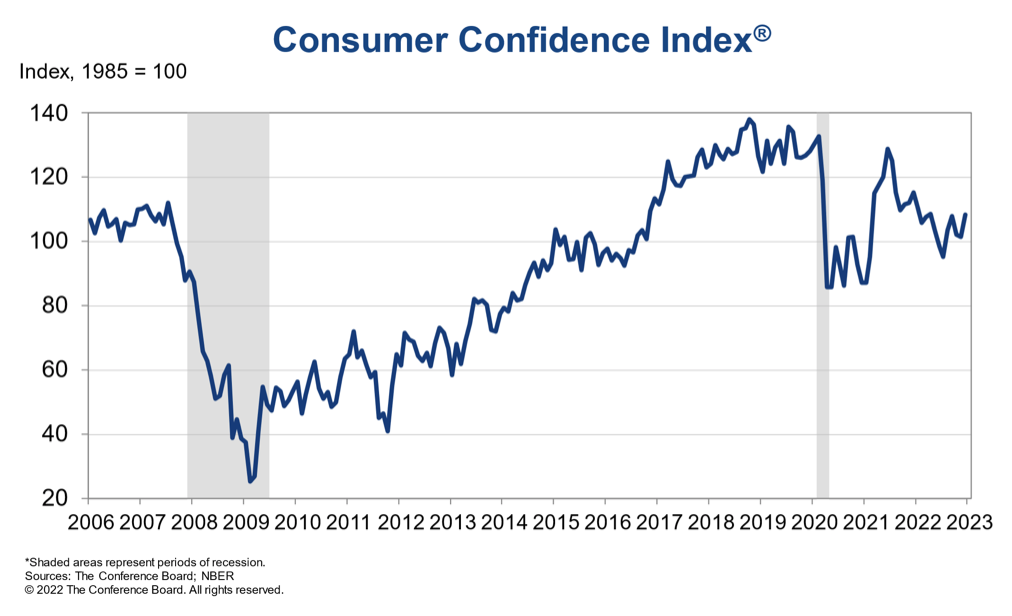

The Conference Board’s US Consumer Confidence index bounced back +6.9 points in December to 108.3, but remains tepid relative to pre-Covid levels.

In December, 19.0% of consumers surveyed by the Conference Board said business conditions were “good,” up from 17.8% in November. 20.1%, said business conditions were “bad,” down from 23.6%. 47.8% of consumers surveyed said jobs were “plentiful,” up from 45.2%, while only 12.0% of consumers said jobs were “hard to get,” down from 13.7% November.

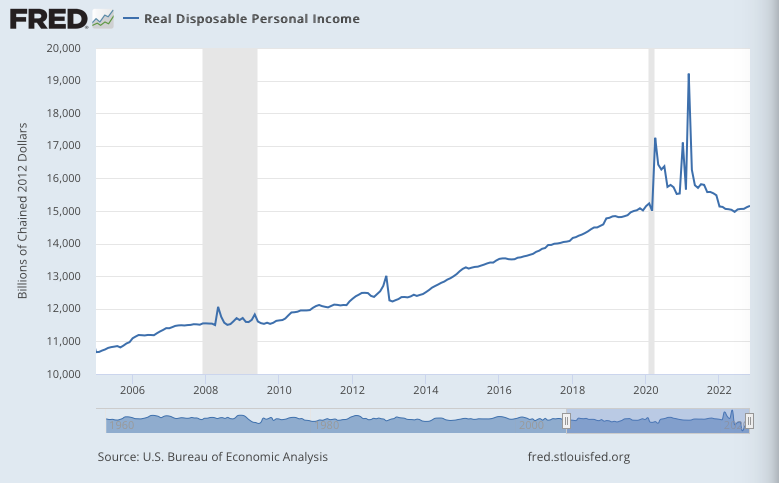

Personal incomes rose +0.4% m/m in November, up +4.7% from a year ago. However, this is unadjusted for inflation. Taking inflation into account, real disposable personal incomes rose +0.3% m/m in November, but were down -2.5% from a year ago.

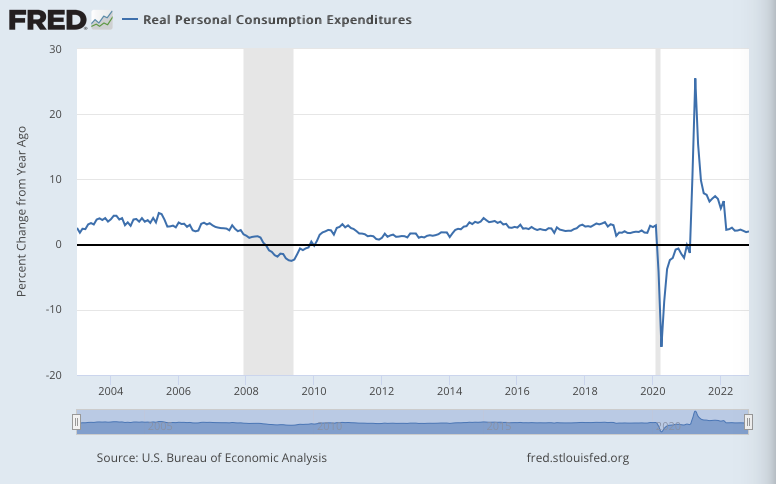

Consumer spending rose +0.1% m/m in November, up +7.7% from a year ago. However, most of this gets eaten up by inflation (with PCE running at +5.5% y/y). So the gain in real spending was flat m/m in November, up only +2.0% from a year ago.

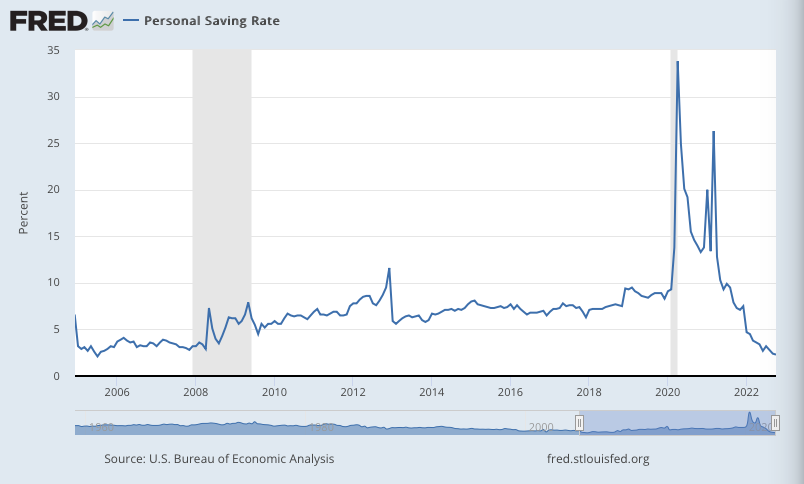

The US personal savings rate rose slightly in November to 2.4%, up from a near-all-time low of 2.2% the previous month (only surpassed by 2.1% in July 2005).

U.S. consumers stockpiled significant savings during Covid, though it’s unclear how evenly distributed they are across income levels. The present drawdown on these savings bears watching.