December 13, 2022

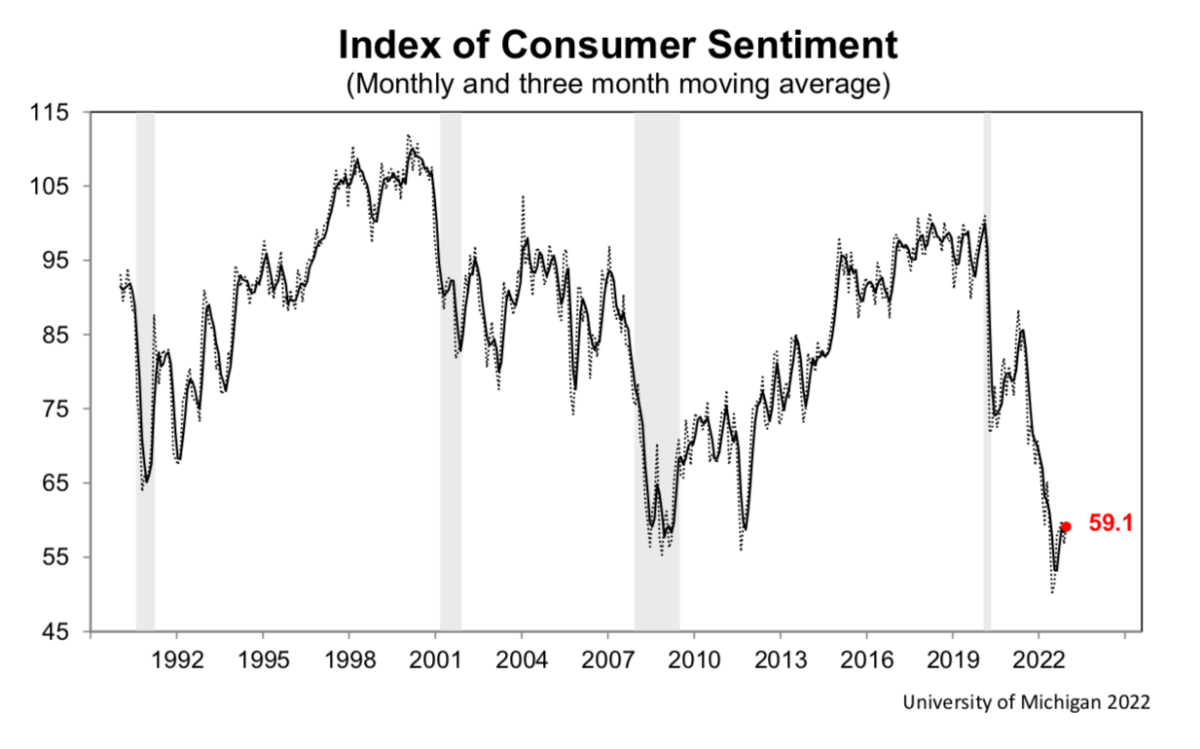

The University of Michigan’s U.S. Consumer Sentiment Index rose +2.3 points in December to 59.1. However, it is still down -16.3% from a year ago.

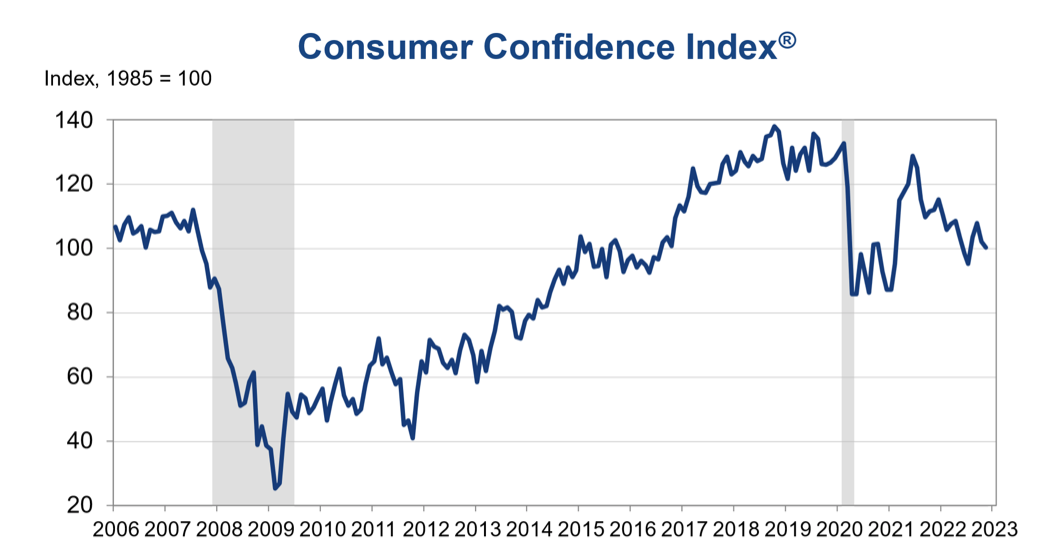

Previously, the Conference Board’s U.S. Consumer Confidence Index declined -2.0 points in November to 100.2.

In November, 18.2% of consumers surveyed by the Conference Board said business conditions were “good,” up from 17.7% in October. On the other hand, more consumers, 26.7%, said business conditions were “bad,” up from 24.0%. 45.8% of consumers surveyed said jobs were “plentiful,” up from 44.8%, while 13.0% of consumers said jobs were “hard to get,” unchanged from October.

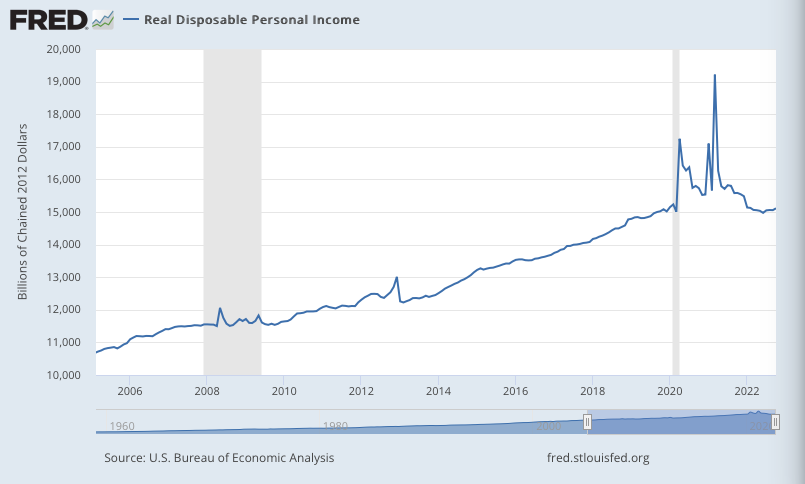

Personal incomes rose +0.7% m/m in October, up +4.9% from a year ago. However, this is unadjusted for inflation. Taking inflation into account, real disposable personal incomes rose +0.4% m/m in October, but are down -3.0% from a year ago.

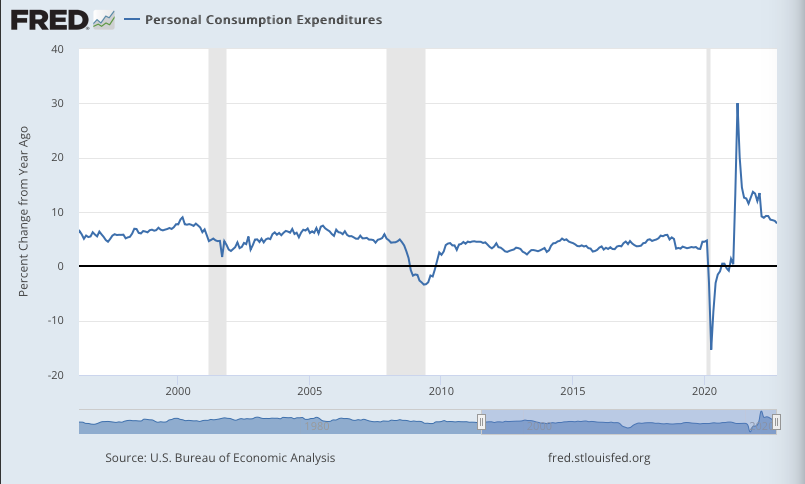

Consumer spending rose +0.8% m/m in October, up +7.9% from a year ago. However, most of this gets eaten up by inflation, running at +7.1% y/y, so the gain in real spending is much lower.

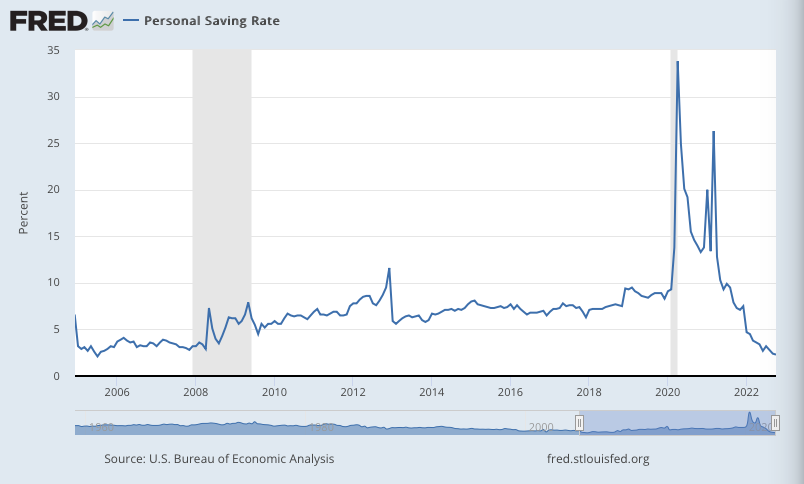

The personal savings rate has declined dramatically to just 2.3% in October, after spiking to record highs during Covid. The current rate nearly matches the all-time low of 2.1% in July 2005.

U.S. consumers stockpiled significant savings during Covid, though it’s unclear how evenly distributed they are across income levels. The present drawdown on these savings bears watching.